The USD-JPY: A Global Currency Tango

The foreign exchange market, often referred to as Forex, is a vast and dynamic ecosystem where currencies are constantly traded against each other. Within this ecosystem, some currency pairs hold more significance than others, and the pairing of the United States Dollar (USD) and the Japanese Yen (JPY), denoted as USD/JPY, is a prime example. This pairing reflects the exchange rate – how many Japanese Yen are needed to purchase one US Dollar. Understanding the factors influencing the USD/JPY can benefit businesses engaged in international trade, investors looking for opportunities, and even travelers seeking the best exchange rates.

The Players in the USD-JPY Dance: Key Factors

The movement of the USD/JPY exchange rate is influenced by a complex interplay of several factors. Here are some of the key players in this dance:

- Interest Rates:The central banks hold the remote for the global economy! Interest rates are one of the buttons they press to impact the USD/JPY exchange rate.

- A higher interest rate in the US compared to Japan would make the USD more attractive to investors, potentially leading to a stronger dollar (lower USD/JPY).

- Economic Performance: The overall health of the US and Japanese economies significantly impacts the currency pair. A stronger US economy often leads to a stronger dollar.

- Risk Aversion: During periods of global economic instability, investors tend to flock to safe-haven currencies like the Japanese Yen. This increased demand can strengthen the Yen relative to the USD (higher USD/JPY).

- Government Intervention: Central banks in both countries can intervene in the foreign exchange market to influence the exchange rate.

Understanding the Impact: Who Benefits?

The fluctuating USD/JPY exchange rate has implications for various groups:

- International Businesses: Businesses importing goods from the US to Japan benefit from a weaker dollar (higher USD/JPY) as it reduces their costs. Conversely, exporting businesses in Japan might prefer a stronger dollar (lower USD/JPY) for higher returns.

- Investors: Understanding the factors influencing the USD/JPY can help investors make informed decisions. For instance, anticipating a stronger dollar might lead to investments in US assets.

- Travelers: Travelers from the US visiting Japan benefit from a weaker dollar (higher USD/JPY) as their dollars can be exchanged for more Yen. Conversely, Japanese tourists visiting the US would prefer a stronger dollar (lower USD/JPY) for more purchasing power.

Tracking the Tango: Resources for Staying Informed

Staying informed about the USD/JPY exchange rate is crucial for those impacted by its fluctuations. Here are some valuable resources:

- Financial News Websites: Major financial news websites provide real-time exchange rate updates, market analyses, and news impacting the USD/JPY pair.

- Financial Apps: Several apps can be downloaded to your smartphone or tablet, offering real-time currency exchange rates and personalized alerts.

- Currency Converter Tools: Online currency converter tools allow for quick conversions between USD and JPY, making it easy to calculate exchange rates for travel or other purposes.

The Future of the USD-JPY Tango: A Look Ahead

Predicting the future of the USD/JPY exchange rate with absolute certainty is challenging. However, by staying informed about the factors influencing it, you can make more educated decisions and potentially benefit from its movements. The global economy is constantly evolving, and as it does, the USD/JPY tango will continue, reflecting the complex relationship between these two major currencies.

Frequently Asked Questions (USD-JPY)

Q: What does a high USD/JPY mean?

A: A high USD/JPY signifies that more Japanese Yen are needed to purchase one US Dollar. In simpler terms, the US Dollar is stronger relative to the Japanese Yen.

Q: What does a low USD/JPY mean?

A: A low USD/JPY indicates that fewer Japanese Yen are required to purchase one US Dollar. This suggests a weaker US Dollar compared to the Japanese Yen.

Q: How can I benefit from fluctuations in the USD/JPY?

A: Understanding the factors impacting the USD/JPY can help businesses, investors, and travelers make informed decisions. For example, a business importing goods from the US to Japan might choose to buy Yen when a weaker dollar (higher USD/JPY) is anticipated.

It’s important to note that foreign exchange trading can be complex and involve risks. Consulting a financial advisor before making any investment could be a wise decision.

More Perks:

- Will Tesla Take Flight? Elon Musk’s Ultimate Flying Car Ambitions

- The World’s First AI Software Engineer: Meet Devin in 2024

- Google Algorithm Update: Unveiling the SEO Landscape of 2024

- Unveiling the Deck: A Deep Dive into Hearthstone Patch Notes

- How to Make Paper in Minecraft: Ultimate Guide for Crafting the Written Word in 2024

- Honor Choice Smartwatch: Unlocking 2024’s Best Feature-Packed Powerhouse

- Shocking – Apple’s Project Titan cancelled: Electric Dream 2024 Scrapped

- China’s Tech Feast at MWC 2024: Transparent Laptops, AI PCs, and 5.5G Beckon

- The Future Unveiled: MWC 2024’s Most Innovative Tech Marvels

- The iPhone 15’s Battery Health: Best Feature, A Leap Ahead

- Circle to Search: No.1 Discovery for Dynamic Searching in 2024!

- Unlocking ChatGPT Plus in 2024: A Deep Dive into the Pros and Cons

Decoding Intelligence: 11 Signs You Might Be Less Smart Than You Think

- Unleashing the OnePlus 12R:Symphony of Affordable Innovation!

- Google Pixel 8 Best wins: Minty Fresh Teaser Unveiled!

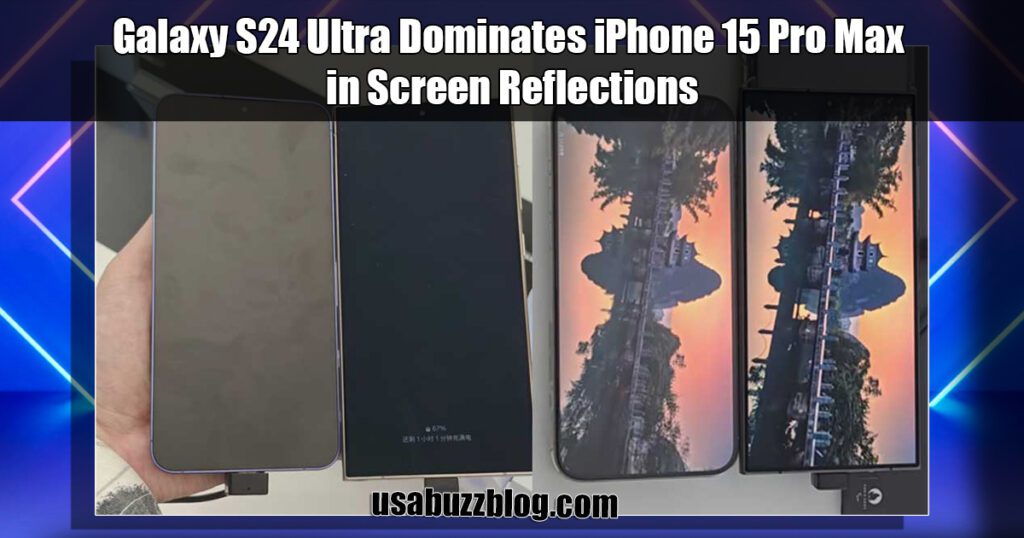

- Galaxy S24 Ultra’s Best Win: Crushes iPhone 15 pro-Max in Reflection Brilliance!

Subscribe To Get New Post Updates VIA Email

Recent Stories

Anwar Hussain

As an Architectural and Interior 3D Visualization Expert, I spend my days crafting stunning visuals that showcase the potential of design. But my passion for storytelling extends beyond the screen. At usabuzzblog.com, I leverage my design expertise to provide insightful and engaging content on Technology, Health & Fitness, Travel, News, Architecture, interior design, and the broader creative landscape. Join me as I explore the latest trends, share design tips, and unveil the stories behind the spaces we inhabit.